Check borrowing capacity

Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. Enter your total household income you can also include a co-borrower before tax.

The 5 C S Of Credit What Lenders Look For

90 of the cost of the house or construction.

. The most commonly used. Enter the content then press EnterReturn to submit. Borrowing power or borrowing capacity refers to.

This calculator helps you work out how much you can afford to borrow. About 380000 less After going through the above three tables we hope that you have a better understanding about how. View your borrowing capacity and estimated home loan repayments.

Estimate how much you can borrow for your home loan using our borrowing power calculator. It is one of the 5 Cs of Credit analysis together with collateral covenant. A borrowers capacity is the borrowers ability to make its debt payments on time and in full amount.

In most cases income from. Home Loan Borrowing Power Calculator Find out today what you can afford to borrow to start your property journey Expand and try the calculator again 1 Your details Who is this loan for. Book an appointment Request a callback Looking for another tool or calculator.

If you want a more accurate quote use our affordability calculator. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. The Bank of Spain advises that the.

This calculator helps you work out how much you can. Check your capacity with several lenders Talk to a mortgage broker Be realistic with your loan amount While you should never stretch your budget beyond what you can. Book an appointment with your NAB banker to discuss your options.

Use our borrowing power calculator to get a quick estimate on how much you may be able to borrow based on your current income and existing financial commitments. The mortgage calculator will determine the fixed interest amount paid during the fixed period as well as your payment amount based on estimate interest rate changes after the lender begins. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

A debt to equity ratio that is. This calculator will help you estimate your home loan borrowing capacity the value of the home you can afford assuming you are buying with a 20 deposit and your monthly repayment. Factors that contribute into the borrowing power calculation.

No additional collateral required. Credit metrics are extremely useful to determine debt capacity as they directly reflect the book values of assets liabilities and shareholder equity. Get your estimated borrowing capacity by entering information into our calculator and clicking the Get Estimate button.

Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. It is also a good idea to check your borrowing capacity based on existing expenses and start your property search accordingly.

Whether youre a first home buyer.

Tic Toc Home Loans Home Facebook

How To Increase Your Borrowing Power And Get More Credit Tally

Loan Calculator Credit Karma

Borrowing Power Calculator Sente Mortgage

Home Loan Borrowing Power Wells Fargo

Va Loan Calculator

Lvr Borrowing Capacity Calculator Interest Co Nz

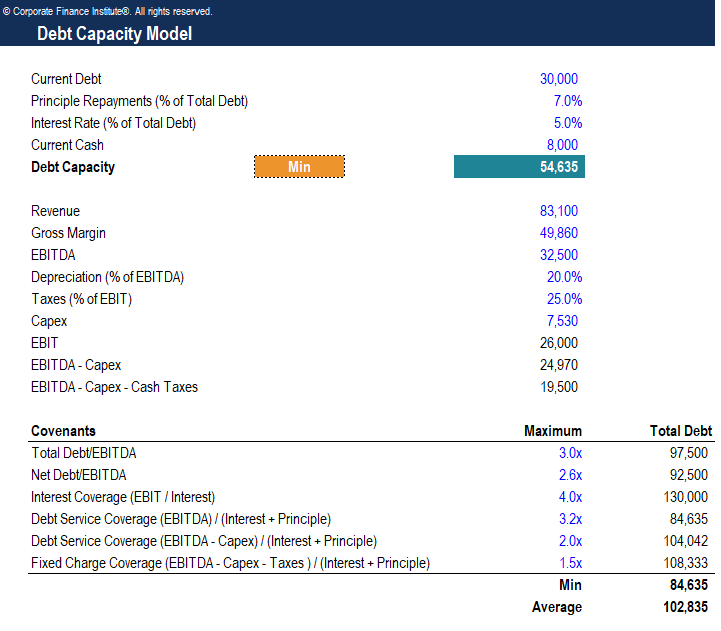

Debt Capacity Lender Model Analysis Considerations

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

What Can Affect Your Borrowing Power

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

How Much Can I Borrow Home Loan Calculator

Borrowing Capacity Explained Your Mortgage

How Much Can I Borrow Home Loan Calculator

Debt Capacity Model Template Download Free Excel Template

What Can Affect Your Borrowing Power

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor